SAP Withholding Tax Tables are the basic and mandatory tools for a business to handle the responsibilities related to tax smoothly, accurately, and efficiently. Like other SAP Tables, these tables are also part of SAP Enterprise Resource Planning System (SAP ERP). The tables store information about tax codes, tax rates, and tax jurisdiction which are essential and basic requirements for tax calculation and withholding taxes from employee paychecks or vendor payments.

In the SAP system, the function of SAP Withholding Tax Tables is the configuration and management of tax deductions from payments that need to be collected from vendors or contractors. Moreover, these tables are flexible and customizable to perform calculations without any error. The SAP automated system deducts withholding tax based on the provided accurate information ensuring that the exact amount is deducted.

In the case of manufacturing firms, these SAP Tables for Withholding Tax are used to calculate the amount of tax from payments delivered to the suppliers of raw materials, components, and furnished goods. Whereas in hospitals these tables assist to deduct the tax from payments delivered to the doctors, nurses, and rest of the medical staff.

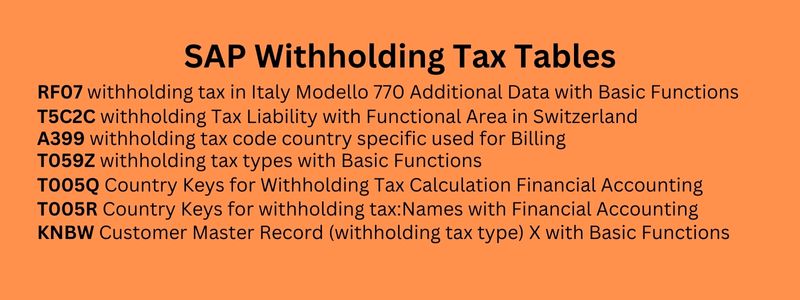

| Table | Descriptions | Functional Area |

| RF07 | Withholding tax in Italy : Modello 770 – additional data | Basic Functions |

| T5C2C | Withholding Tax Liability | Switzerland |

| T5C2J | Withholding Tax Liability | Switzerland |

| T059K | Withholding tax code and processing key | Basic Functions |

| A399 | Withholding tax code – country-specific | Billing |

| T059P | Withholding tax types | Basic Functions |

| T059Z | Withholding tax code (enhanced functions) | Basic Functions |

| T5C1S | Withholding Tax Rates (CH) | Switzerland |

| T5C2B | Withholding Tax Bases | Switzerland |

| T059Q | Withholding Tax | Financial Accounting |

| T5C2L | Withholding tax – payroll number | Switzerland |

| RBWS | “Withholding Tax Data | Invoice Verification |

| RBWT | “Withholding Tax Data | Invoice Verification |

| VITMWT | Term: Withholding Tax | Rental Accounting |

| T5C1Y | Fee for Withholding Tax | Switzerland |

| T059O | Official withholding tax key – Descriptions | Basic Functions |

| T5C1T | Texts for Withholding Tax | Switzerland |

| T5C2G | Texts for Withholding Tax | Switzerland |

| T059U | Text Table: Withholding Tax Types | Basic Functions |

| T059ZT | Text table: Withholding tax codes | Basic Functions |

| T5C2MT | Payroll unit: Withholding tax texts | Switzerland |

| T5C2M | Payroll unit – withholding tax | Switzerland |

| T005Q | Country Keys for Withholding Tax Calculation | Financial Accounting |

| T059OT | Text table: Official withholding tax key descriptions | Basic Functions |

| T005R | Country Keys for the Withholding Tax: Names | Financial Accounting |

| LFBW | Vendor master record (withholding tax types) X Basic | Functions |

| DFKKQSR | Individual Records for Withholding Tax Report | Contract Accounts Receivable and Payable |

| KNBW | Customer master record (withholding tax types) X | Basic Functions |

| T059FB | Formulae for calculating withholding tax (new functions) | Basic Functions |

| T059F | Formulas for Calculating Withholding Tax | Financial Accounting |

| T059V | Reasons for exemption per withholding tax type | Basic Functions |

| T059W | Reasons for exemption per withholding tax type | Basic Functions |

| T059C | Types of Recipient: Vendors per Withholding Tax Type | Basic Functions |

| T059D | Types of Recipient: Vendors per Withholding Tax Type | Basic Functions |

| T001WT | Company code-specific information per withholding tax type | Basic Functions |